GPU giant NVIDIA (NVIDIA) announced its financial report for the third quarter of fiscal year 2026. Its performance exceeded expectations, causing its stock price to rise sharply. In addition, the sales of Blackwell architecture AI chips are "unstoppable", and it has firmly established its leading position in AI infrastructure.

According to NVIDIA’s financial report for the third quarter of fiscal year 2026, its revenue and earnings per share (EPS) easily exceeded market expectations. In addition, NVIDIA's sales forecast for the fourth quarter also exceeded analysts' estimates. This dazzling financial report showed that the world's "greedy demand" for artificial intelligence (AI) chips has not yet been met. Shares of the AI chip maker soared more than 6% in after-hours trading on the news.

The financial report showed strong growth compared with market survey analysts' expectations. That included total revenue of $57.01 billion, well above market expectations of $54.92 billion. Net income surged by $653 million from $19.31 billion in the same period in fiscal 2025. Adjusted earnings per share (EPS) actually reached $1.3, which was also higher than market expectations of $1.25, and even exceeded the $0.78 in the same period in fiscal 2025. In addition, NVIDIA has provided an extremely optimistic financial forecast for the current quarter (the fourth quarter of fiscal year 2026), with expected revenue of approximately US$65 billion, which is much higher than the US$61.66 billion previously expected by market analysts.

NVIDIA's sales and prospects are closely watched throughout the technology industry as it is seen as an important indicator of the health of the current AI craze. Among them, the data center business is NVIDIA's key business. The financial report shows that the data center business is the core of the explosive growth in the third quarter. In the third quarter, NVIDIA's data center revenue reached $51.2 billion, easily exceeding analysts' expectations of $49.09 billion and achieving an astonishing annual growth of 66%.

Data center revenue is mainly composed of two parts. The first is the computing part, which specifically refers to the company’s GPU chip sales, which contributed US$43 billion in revenue. The company noted that the main driver of this growth came from initial sales of its GB300 chips. Next is the networking part. This part of the hardware allows a large number of GPUs to work together to form a supercomputer. As a result, this business contributed $8.2 billion to data center sales in the third quarter.

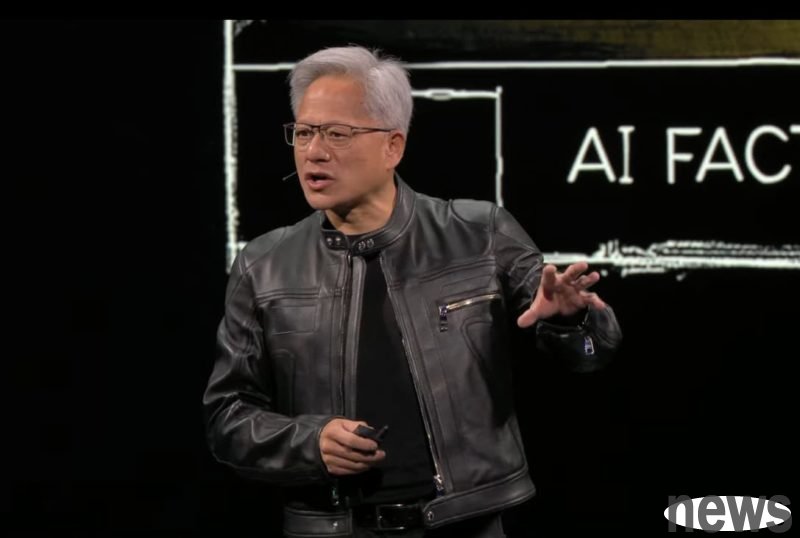

NVIDIA founder and CEO Jensen Huang said that sales of the company's current generation of Blackwell architecture GPU chips have reached an "unstoppable" level (off the charts). This performance eliminates investors' concerns that NVIDIA's rapid performance will mainly flow to a few cloud service providers, which may cause a bubble. Huang Renxun further emphasized that all cloud GPUs have been sold out. NVIDIA Chief Financial Officer Colette Kress added in a statement that the company's current best-selling chip series is Blackwell Ultra, which is the second-generation version of the company's Blackwell chips.

Huang Jen-Hsun previously revealed in October that NVIDIA has received AI chip orders worth a total of US$500 billion in 2025 and 2026. Therefore, relying on the strong market demand for AI chips, NVIDIA has become the world's most valuable listed company. The company's customers include cloud service providers such as Microsoft, Amazon, Google, Oracle and Meta, as well as all leading technology companies that use NVIDIA's chips to develop new artificial intelligence models.

At the financial report meeting, Chief Financial Officer Colette Kress drew a grand blueprint for the future market size. She said the company believes NVIDIA will be the "excellent choice" in the $3 to $4 trillion annual AI infrastructure construction market. This expectation is consistent with increased capital expenditures by major customers. Because several of NVIDIA's largest customers and peers, including Microsoft, Meta, Amazon, and Alphabet, have increased their capital expenditure forecasts for AI implementation. These companies now expect to spend a total of more than $380 billion on AI infrastructure in 2025.

In fact, before the rise of the AI craze, NVIDIA was best known for manufacturing chips for video games. Although the data center business is now the leader, NVIDIA's traditional business lines are also showing healthy growth. Among them, game business revenue reached US$4.3 billion, an increase of 30% compared with the same period in fiscal year 2025. Professional visualization business revenue was US$760 million, an annual growth rate of 56%. It should be noted that such product sales include revenue from NVIDIA’s AI desktop computer product DGX Spark released earlier in 2025. Finally, there is the automotive and robotics business, which NVIDIA has highlighted as one of the most important growth areas in the future. Its third-quarter revenue totaled $592 million, up 32% year over year.